Bank Recapitalisation: CBN Expects The Banking System to Support Tinubu’s Proposed $1 Trillion Nigerian Economy

President Bola Tinubu

By Oluwatosin Oladetan

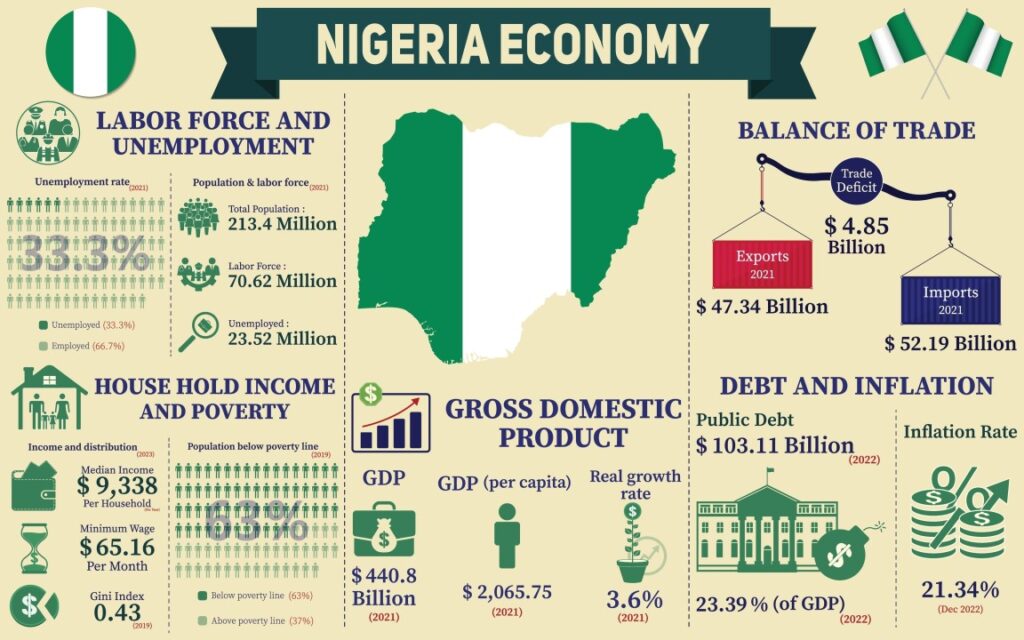

During the presidential address of the 29th edition of the Nigerian Economic Summit held in October 2023, President Bola Tinubu proposed to the House that a $1 trillion economy is possible by 2026 and a $3 trillion economy is possible before 2030 through double-digit, inclusive, sustainable, and competitive growth in the Gross Domestic Product (GDP) of the country.

The Nigerian real GDP as of 2023 was ₦76.684 trillion, or about $85.362 billion, when translated at the central rate for the last official foreign exchange rate of the ₦/$ available for the year 2023.

When taking into consideration the further naira devaluation, persistent increase in inflation rates, crude oil price, local and foreign debt obligations, external reserves, and market capitalization, the attainment of this set target is very daunting and challenging.

A key resource that will aid in attaining this high mark within the timeframe communicated by the presidency is a very strong financial system.

The financial policy and regulation arm of the Central Bank of Nigeria (CBN) issued a circular a few days ago to all commercial, merchant, non-interest banks, and promoters of proposed banks on the need to review the minimum capital requirements in line with Section 9 of the Banks and Other Financial Institutions Act (BOFIA) 2020, of which one of the statutory responsibilities of the Central Bank is to promote a safe, sound, and stable banking system.

The proposed minimum capital base across the different segments of the banking system is as slated below:

Commercial bank with international authorization: $500 billion

Commercial bank with national authorization: ₦200 billion

Commercial bank with regional authorization: ₦50 billion

Merchant bank with national authorization: ₦50 billion

Non-Interest bank with National Authorization: ₦20 billion

Non-Interest bank with Regional Authorization: ₦10 billion

The circular provided several options to be explored by banks in raising the minimum capital, which is expected to be paid-up capital and share premium only on or before March 31, 2026, which infers a period of 24 months from April 1, 2024.

Listed below are the options made available for banks to explore:

- An upgrade or downgrade of license authorization: this infers an expansion or restriction of the target customer pool, product offering, and service offering of the concerned bank.

- Mergers and Acquisition: A form of corporate restructuring through which a bank purchases another bank without the formation of a new bank (acquisition) or the consolidation, merger, and fusing of several banks leading to the formation of a new bank (merger).

- Fresh Equity Capital Injection: attraction of funds through private placement, which is a system through which there is no interference with the public or stock market as the capital increase is through the inflow of funds from high-net-worth individuals (HNI) and institutional investors.

- Right Issue is a system through which the bank concerned can raise additional capital by expanding the number and value of shares held by existing shareholders at a price most likely lower than the current market price in proportion to their existing shareholdings.

- Offer for Subscription, a system through which the bank concerned can raise additional capital from anyone willing and available to take a position on the bank’s equity position on the stock or available exchange.

The minimum capital requirement applies immediately to any institution that intends to submit applications for a banking license starting from April 1, 2024.

All existing banks and promoters who have pending applications for a banking license with the CBN are also required to submit an implementation plan for increasing their capital to the Director of Banking Supervision Department of the Central Bank of Nigeria on or before April 30, 2024.

A critical review of the twenty-five banks currently operating in the Nigerian financial services sector indicates that all Nigerian banks will be involved in increasing their paid-up capital and share premium as none are compliant with the requirements of the revised framework.

Banks would have been more comfortable with the capital base adjustment if the basis had been pegged to total equity rather than paid-up capital, even though some banks have negative shareholders’ funds.

The proposed capital base is still less than the dollar equivalent of the minimum capital base required of banks between July 2004 and December 2005, when the capital base was increased from ₦2 billion to ₦25 billion by the Central Bank of Nigeria when Charles Chukwuma Soludo was the Governor.

The circular further stressed the strict compliance with maintaining the minimum capital adequacy ratio (CAR: the bank’s capital divided by its risk-weighted assets) in line with the Basel Committee on Banking Supervision framework appropriate to their banking license authorization, which requires commercial banks to maintain a minimum regulatory CAR of 10% for banks with regional or national authorization and 15% for banks with international authorization.

In a bid to fulfill one of the core objectives of the Central Bank of Nigeria, which consists of promoting a sound financial system in Nigeria, the banking sector recapitalization program will help the Nigerian economy achieve the following:

Stronger Economy: The banking sector is one of the sectors pivotal to the development of the Nigerian economy; over 50% of the equity positions in the Nigerian stock market are from the banking sector.

The government also has an interest in some of the institutions classified as systemically important banks, as their collapse can lead to a contagion collapse effect on the whole economy.

This program will enable the banks to increase their ability to avert systemic shocks and causalities from bank exposure.

The program will reduce the total money in circulation within the range of $4 trillion to $5 trillion if there is no inflow of funds from other regions.

Quality of Financial Reporting: CBN emphasized the equity line item that will be impacted by this recapitalization.

This structure avoids the manipulation that can arise from accounting treatment, financial engineering, business risk, volatilities, business risks, and subjectivity that may impact comparability and analysis.

This helps increase compliance with the capital adequacy requirement of the Basel III accord.

Investments: The program will provide the opportunity for a fresh inflow of investment into the Nigerian market.

The Central Bank of Nigeria has, over the last few weeks, released several policies to reduce the volatility of the foreign exchange rate and attract suitable foreign direct investments (FDI) and foreign portfolio investments (FPI).

This program provides an opportunity for sustainable equity investments in one of the sectors pivotal to the advancement of the Nigerian economy.

This program will create the right economic environment for the appreciation and acceptance of the Nigerian naira in the international market.

The increased stability in the exchange rate will further support economic stability, provide an opportunity for a downward slope in interest rates, and increase the contribution of other industries to the total gross domestic product (GD) through access to debt funding capital at a more considerable and sustainable cost for the business.

The right investments across several industries of the economy will lead to increased total-factor productivity and stimulate business activities for companies that are currently micro, small, and medium-scale enterprises.

Employment: There will be a need for skill refinement and enhancement of employees in the banking industry as there will be layoffs, early retirement, and changes in job roles and responsibilities in the event some banks opt for the route of mergers and acquisitions.

A key factor to be considered by banks that will likely use the merger and acquisition route is the quality of the target firm. Earnings (revenue, direct costs, indirect costs), Position (Risk Assets (Loans and Advances), Customer Deposits (Current Account, Savings Account, Term Deposits), Off-Balace Sheets (Overdrafts, Leases, Letters of Credit, Bonds, Guarantees, Lease Indemnities), Structure, Governance, and other factors worth considering prior to investments and corporate restructuring.

The Nigerian credit-to-gross domestic product (GDP) ratio is significantly low and has an impact on the high level of unemployment in the country.

Hence, there is a need to promote sustainable credit and access to finance programs for the other sectors of the economy that require credit finance for conceptualization, penetration, growth, and expansion.

The revised capital base of the banking industry will increase the amount banks and financial institutions can avail of as credit to customers.

Read Also: Edo State now 3rd Most Indebted State in Nigeria, Owes N570 Billion Domestic, External Debt

7 thoughts on “Bank Recapitalisation: CBN Expects The Banking System to Support Tinubu’s Proposed $1 Trillion Nigerian Economy”