Edo State now 3rd Most Indebted State in Nigeria, Owes N570 Billion Domestic, External Debt

By Correspondent

Edo State economy is currently sick as a result of her increasing debt profile caused by the immodest administration of Mr. Godwin Obaseki since assuming office in 2016 as governor of the state.

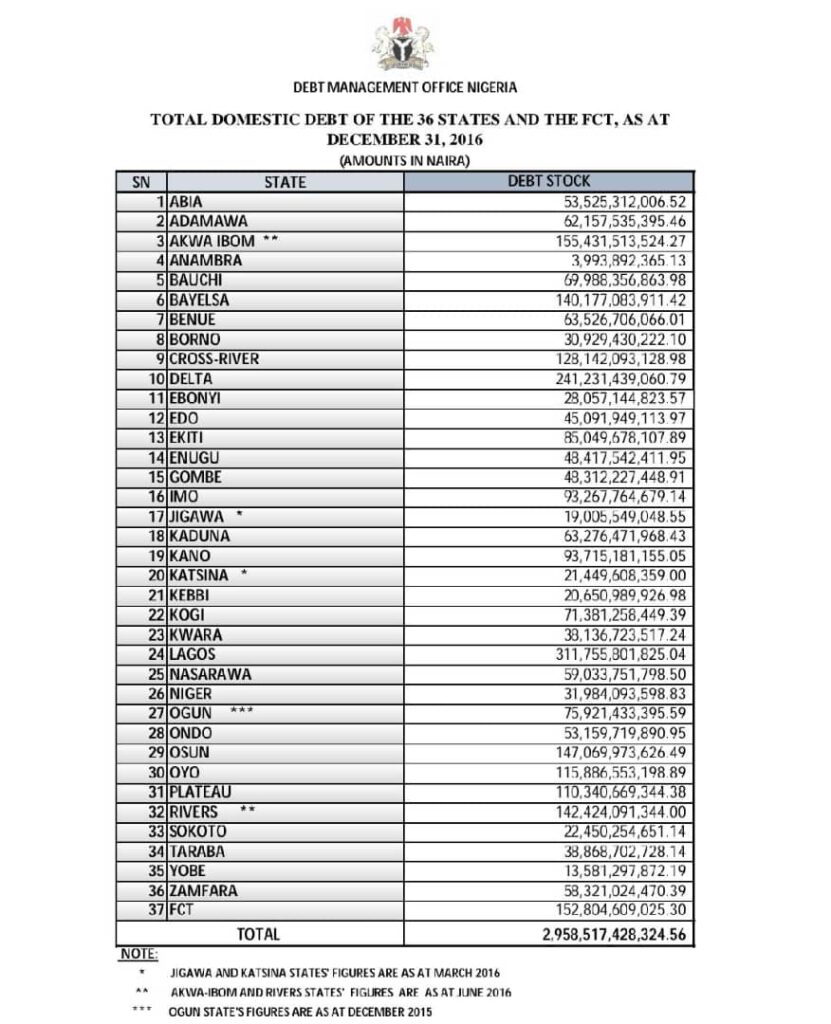

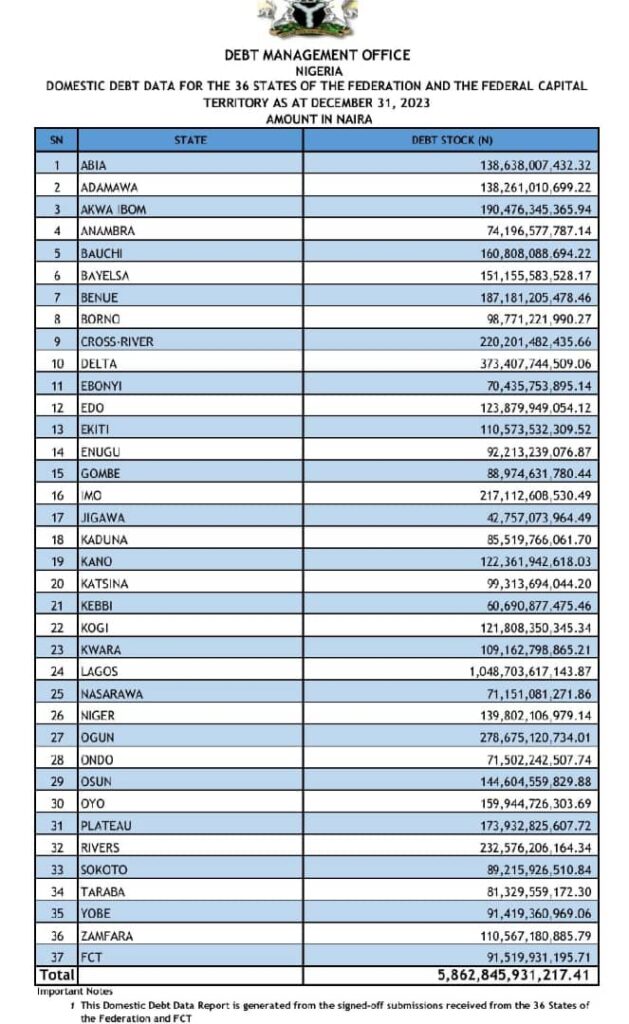

Over the period, the Domestic Debt has increased from N45.091 billion in December 31, 2016 when Obaseki took over power from Comrade Adams Oshiomhole, to N123, 879 billion in December 31, 2023.

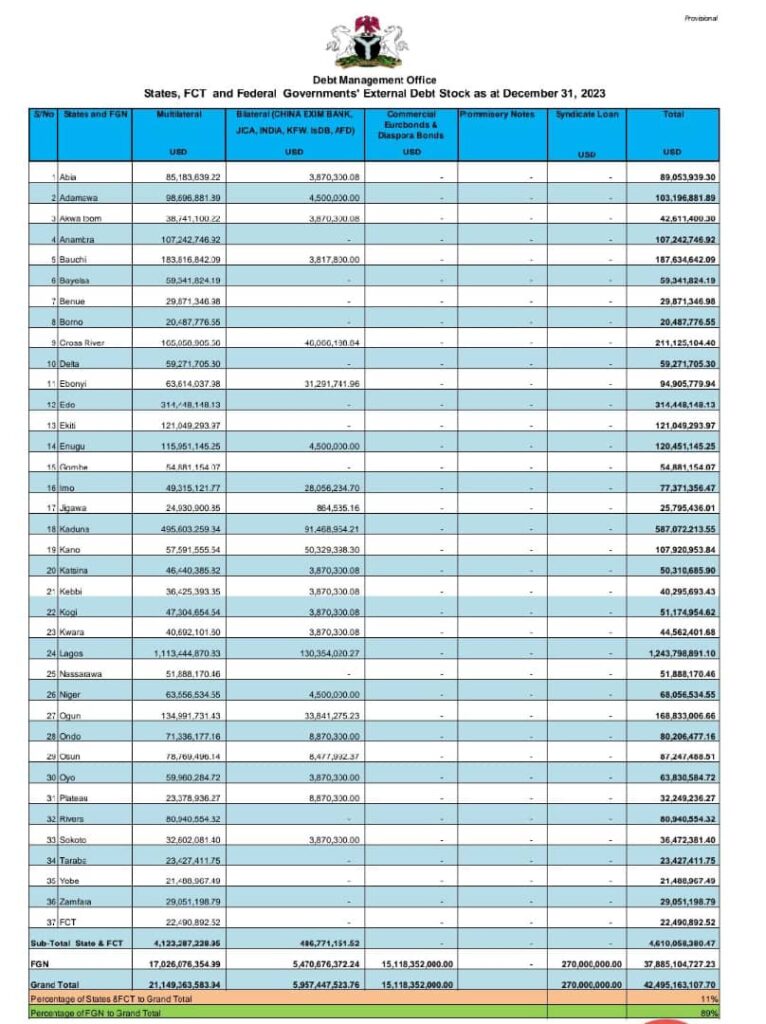

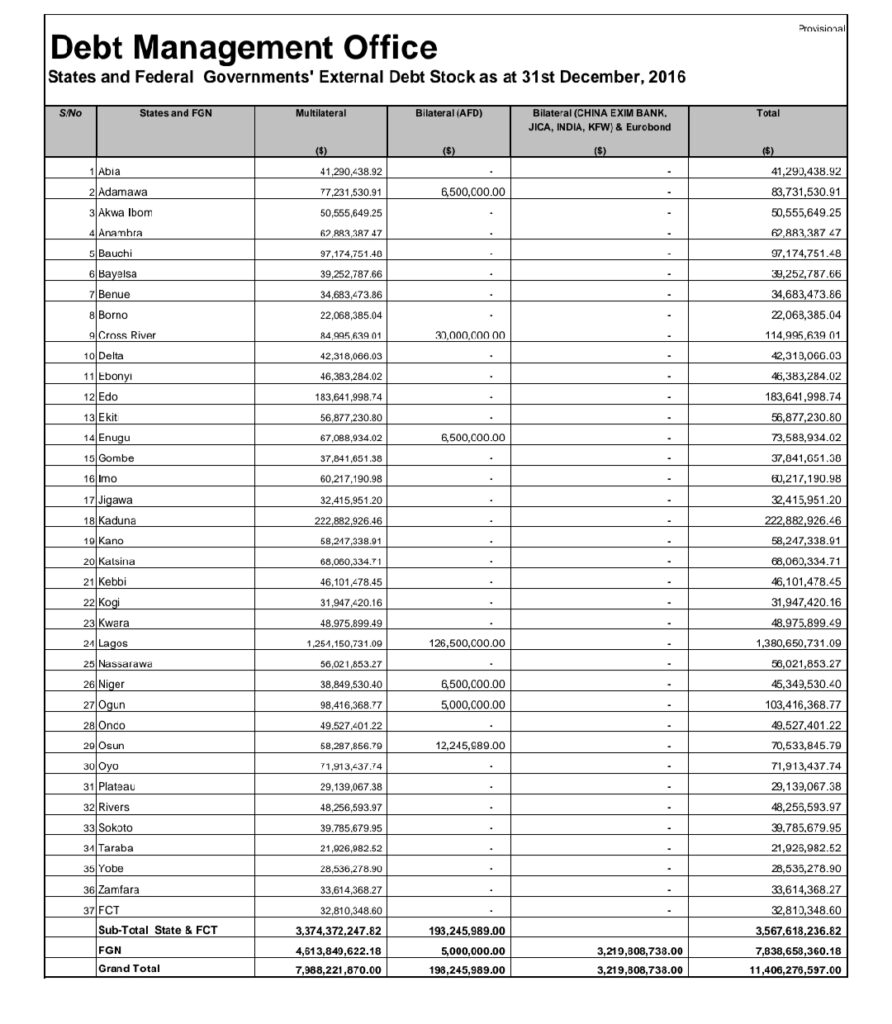

In the same manner, Edo State External Debt leaped from $183.641 million in December 31, 2016 to $314, 448 in December 2023.

This signifies an increase of N78.788 billion in domestic debt; and $130,841 million in debt stocks. These figures were released by the Debt Management Office.

At the current prevailing exchange rate, Edo State External Debt amounts to N445,430,980,000.00 (Four Hundred and Forty-Five Billion, Four Hundred and Thirty Million, Nine Hundred and Eighty Thousand Naira).

In summary, the total debt profile of Edo State -Domestic and External is a total of N569,430,980,000 (Five Hundred Sixty-Nine Billion, Four Hundred Thirty Million, Nine Hundred and Eighty Thousand Naira). This is well over half a trillion naira.

This figure places the state in 3rd position, coming behind Lagos and Kaduna States who are occupying the 1st and 2nd positions respectively.

The December 2023 records of Edo State foreign debt did not capture the $75 million ‘school improvement’ loan that the present administration borrowed from the World Bank late last year.

According to search at some commercial banks, the domestic debt recorded by the Debt Management Office did not cover the term loan and overdraft that Sterling banks and others have extended to the state in the past 12 months.

Domestic Debt of 36 States as at December 31, 2016

Also outstanding are two loans totalling N11bn for the “development of the state’s agricultural sector and job creation’ which was approved by the State House of Assembly, after a request by governor via a letter dated May 2 and May 5, 2017. Governor Obaseki requested the loans that was needed, included N6bn from the CBN’s Anchor Borrower loan facility and ‘N5bn to fund the agricultural projects in the state.”

Obaseki in his letter told the Assembly that the N5bn earmarked for agricultural projects in the state would be used for the development of “…5,000 hectares and the establishment of five green houses for tomatoes and vegetable production and 120 fish ponds.”

External Debt of 36 States as at December 31, 2023

Obaseki also noted that the N11 billion loans were aimed at “…reviving all moribund fertiliser plants across the state and creating wealth.”

In it’s effort to support self sufficiency in food production, the CBN had set aside N40bn for farmers at a single-digit interest rate of 9 per cent and Edo State Government received N5bn for farmers.

While debt financing should otherwise helpe to develop the states, and like the case of Edo State, boost production in the agricultural sector, and increase capital infrastructure, Godwin Obaseki’s administration has misapplied the tones of accumulated loans without commensurate infrastructure across the sectors.

For example, in July 2021, Edo farmers petitioned Obaseki to former President Mohammadu Buhari and the Economic and Financial Crimes Commission, EFCC over alleged misuse of N75bn agric loans.

External Debt of 36 States as at December 31, 2016

Amongst their complaints were that, none of their members got the monies in spite of the fact they applied for it since 2017. The farmers were under the auspices of Edo State Concerned Farmers Association.

The group that was led by Comrade Afeiye Muhammed claimed then that they procured the loans from the Central Bank of Nigeria and the World Bank.

The farmers said that, in 2017 they participated in the Agripreneur programme in Sobe, Owan West Local Government Area of Edo State, where they planted and harvested Maize. But however, since the harvest three years after, they were yet to receive proceeds from the sale of their Maize by Edo State Government and SARO Agro Sciences Limited.

“In 2019 we also participated in the Agripreneur programme in Agenegbode, Etsako East Local Government Area, where we planted and harvested rice. Since the harvest in October 2019, Edo State Government and Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL) took our rice for processing and sale in Abakaliki. However, we have waited in vain for 9 months, and till date, the proceeds from the sale of our rice have not been paid back to us.

“Additionally, the ₦69 Billion Naira CBN Loan invested into Edo State Oil Palm Programme, have been hijacked, Local farmers in the State were removed from the programme.

“Additionally, we want Nigerians to know that funds for Fadama 111 Project Additional Financing, were never disbursed to farmers in Edo State.

“Over the years, contracts for the implementation of World Bank-funded projects in Edo State have been overinflated and awarded to briefcase companies In some cases, these contracts are never executed or poorly executed after complete payments have been collected by these briefcase companies.” The angry farmers cried.

The farmers called on the CBN to take urgent steps to ensure that Edo State Government, SARO Agro Sciences Limited and NIRSAL pay Edo State Farmers, proceeds from the sale of their crops between 2017 and 2019.

Domestic Debt of 36 States as at December 31, 2023

They also called on the CBN and World Bank as well as other financial institutions to stop further disbursement of Loans to Edo State Government, and instead carry out a thorough investigation into how previous loans between 2016 and 2020 were spent, and those responsible for embezzling these Loans should be prosecuted and made to refund the stolen funds.

The farmers pleaded with the Governor of CBN and the Country Director of World Bank, to investigate the scheme.

“We plead with you not to cover up these fraudulent activities in Edo State, but to immediately commence a thorough forensic investigation in partnership with the EFCC, ICPC and Civil Society Groups in Edo State, and those found to have misappropriated these funds should be prosecuted.”

Worried by the dilapidating debt overhang and stagnation of economic growth, experts have called on the state House of Assembly to pass a resolution stopping the state government from accessing further loans, because Edo State is presently unable to meet her financial obligations to contractors and lenders.

3 thoughts on “Edo State now 3rd Most Indebted State in Nigeria, Owes N570 Billion Domestic, External Debt”