Heavy Debt Burden Drives Struggling Nigerian Breweries to Raise N600bn from Capital Market

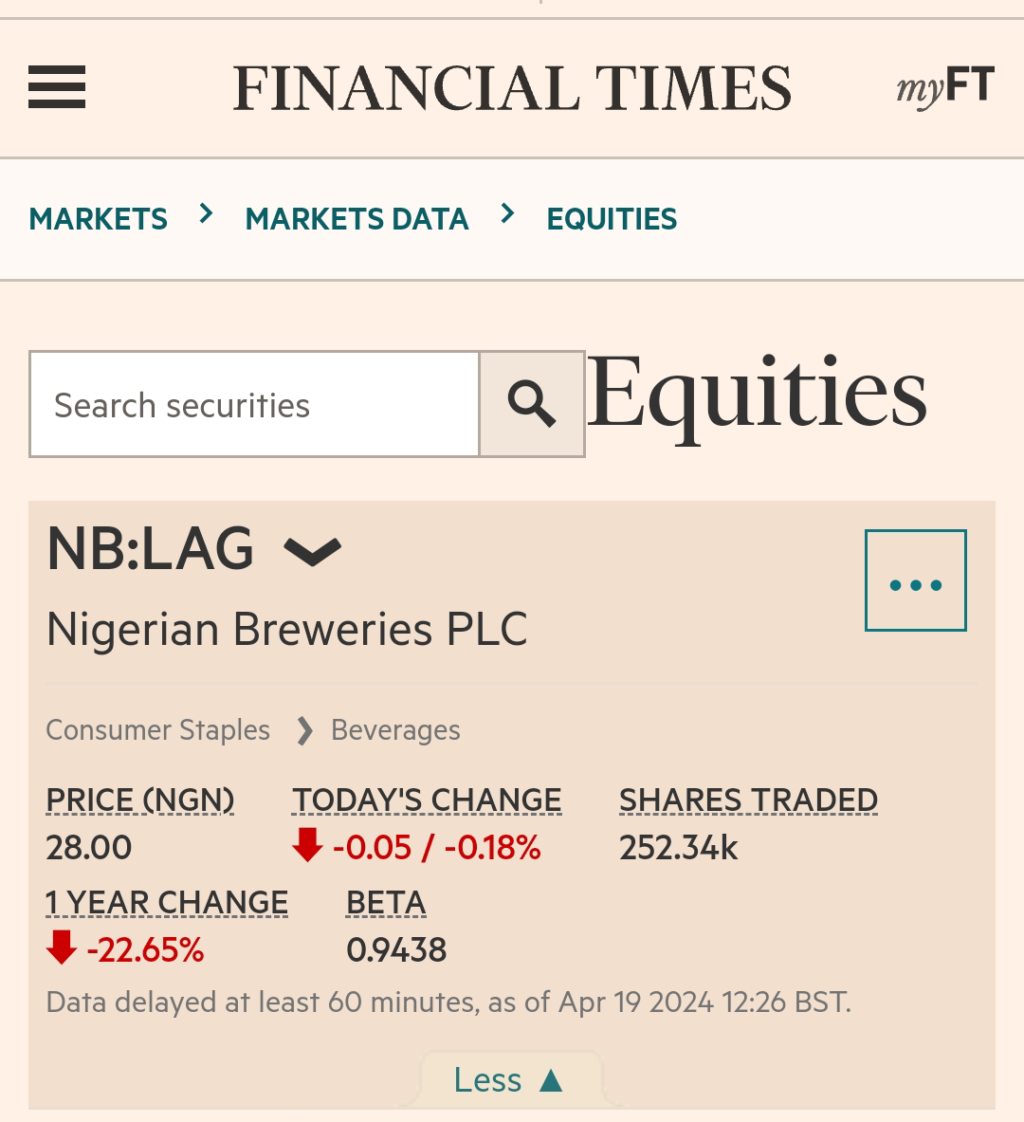

Report of downward trend of Nigerian Breweries Shares today at Nigerian Stock Exchange

By Correspondent

As the shares of Nigerian Breweries continue to fall, nearing all-time low, following the N146bn loss suffered in 2023 trading year. The company has resulted to dilute its shares through rights issue to raise N600 billion to settle offshore and local bank loans.

According to reports monitored in Thisday and Businesday, the management of NB Plc has disclosed that, it is set to seek shareholders’ approval to raise N600 billion fresh capital via rights issue at its forthcoming Annual General Meeting (AGM) in Lagos.

The acting Chairman, Mr. Sijbe “Siep” Hiemstra in a memo, stated that the objective of the N600 billion fresh capital was targeted at settling the outstanding foreign exchange outstanding and part of the local bank loans hanging on the company.

Nigerian Breweries further added that it has informed the Nigerian Exchange Limited and the investing public at a specially convened meeting of the Board of Directors of the Company held on the 2nd of April 2024, that the Board resolved to recommend to shareholders at the next Annual General Meeting (AGM), the inevitability to raise of up to N600 billion capital by way of Rights Issue, subject to regulatory approvals.

“The company’s share price which closed at N29.05 on Wednesday is nearing a 52-week low of N27.95 as against 52-week high of N46.5,” one of the reports said.

Businesday reported that Nigerian Breweries blamed the downward value of the company to the negative impact of the company’s debts, which they hope the proceeds from the Rights Issue will help to reduce and lead to a healthier balance sheet.

“The brewer’s audited results for the year ended December 31, 2023 shows its group revenue grew by 8.9 percent to N599.643billion from N550.638billion in 2022.

“However, in a review of 2023 financial year, the NB Plc reported pre-tax loss of N145.224billion, from N17.341billion pre-tax profit in 2022.”

Also, “…it reported group Loss After Tax (LAT) of N106.308billion in FY’2023 from profit after tax (PAT) of N13.187billion in 2022.”

In same van, “…basic loss per share stood at 1,280 kobo from basic earnings per share of 158kobo.

“Coupled with ongoing cost savings and other operational efficiency efforts, the Board is optimistic about steering the Company back to the path of sustainable profitability in the near future,” Businessday wrote.

The Board also resolved to recommend to shareholders at the AGM scheduled for the 26th of April 2024, the increase in the Company’s share capital to take care of the new shares to be allotted under the Rights Issue.

Read Also: Breaking: How Nigerian Breweries Got into Financial Trouble…Records N145 Billion Loss in 2023

1 thought on “Heavy Debt Burden Drives Struggling Nigerian Breweries to Raise N600bn from Capital Market”